Surveys for companies come in various forms and serve multiple purposes, from gauging customer satisfaction to measuring employee engagement.

Which is why we’ve compiled the complete list of surveys for companies, along with key questions about their implementation and potential risks.

Table of Contents

What are surveys for companies?

The list of surveys for companies is a long one, but essentially they are any survey that contributes to businesses meeting their goals.

This includes collecting customer feedback, measuring the success of internal processes, gauging employee satisfaction, and much, much more.

We’ve created this ultimate list to provide you with concrete methods for improving your business with surveys.

List of surveys for companies

Without further ado, let’s get into the complete list of surveys for companies to start helping you build better relationships with your audience.

Customer surveys

We’ll start with the surveys that help you grow closer to your customers and help you identify ways you can increase sales and boost retention.

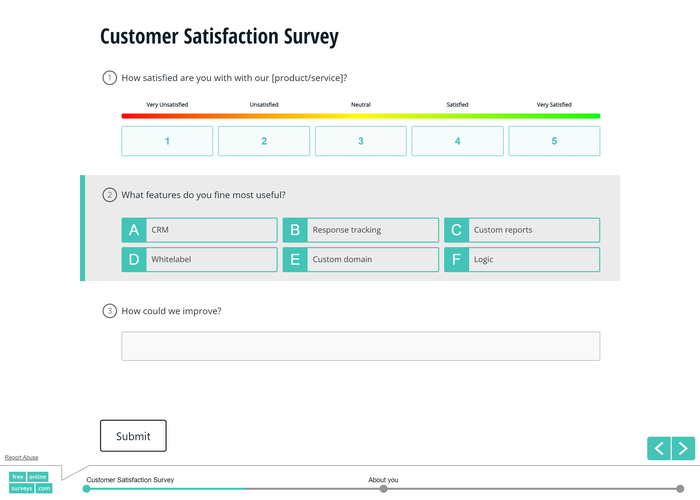

1. Customer satisfaction (CSAT)

Customer satisfaction surveys (CSAT) gauge how satisfied customers are with your business. They can be as specific as satisfaction with products or customer support, or as general to address overall satisfaction with your brand.

Their aim is to identify your strengths and weaknesses, with the ultimate goal being to strengthen customer relationships and increase retention.

These surveys can also be used to collect customer testimonials as social proof for your business.

2. Net Promoter Score (NPS)

Net Promoter Score (NPS) is a metric for measuring customer loyalty, where customers are asked “how likely are you to recommend our [company/ product/ service] to a friend or colleague?“.

The question is accompanied by an 11 point scale, ranging from 0 to 10. Those who select between 0 and 6 are detractors, those who select 7 or 8 are passives, and those who select 9 or 10 are promoters.

Promoters are your most loyal customers, your advocates, who’re ready to recommend you to other people.

Your final NPS is a number between -100 and 100, where a higher number represents a higher factor of customer loyalty.

3. Customer effort score (CES)

The basic principle of Customer Effort Score (CES) surveys is to identify where customers expend the most effort to complete tasks, and reduce that friction.

Typically, these surveys will ask “how easy was it for you to [complete task, resolve issue, etc.]?”.

Survey responses are given along 5 or 7 point rating scales (consistency is key), ranging from “Very Easy” to “Very Difficult”.

4. Customer service

Surveys focused on customer service help companies evaluate the effectiveness of existing support structures. The feedback gathered should reveal:

- How easy it is for customers to contact support agents.

- The quality of support provided.

- How quickly agents respond to and resolve issues.

Results should then be passed to the customer service team for improvements to be made.

5. Post-purchase

Post-purchase surveys allow you to identify the contributing factors to a customer purchasing a product or service.

They can help you discover ways in which you can boost conversions, remove friction from the purchasing process, and learn why customers chose you over the competition.

6. Cancellation

As import as it is to find out why people become customers, it’s even more important to learn why customers leave. Once a customer cancels their subscription/ contract or stops purchasing from you, it’s essential you ask for feedback.

It might be as innocuous as simply not needing your product or service any more. But if customers are experiencing an issue, or competitors are have a better offering, you absolutely need to know.

Employee surveys

Your employees are as important as your customers, if they’re unsatisfied in their role or company processes are impacting productivity, you need to know about it.

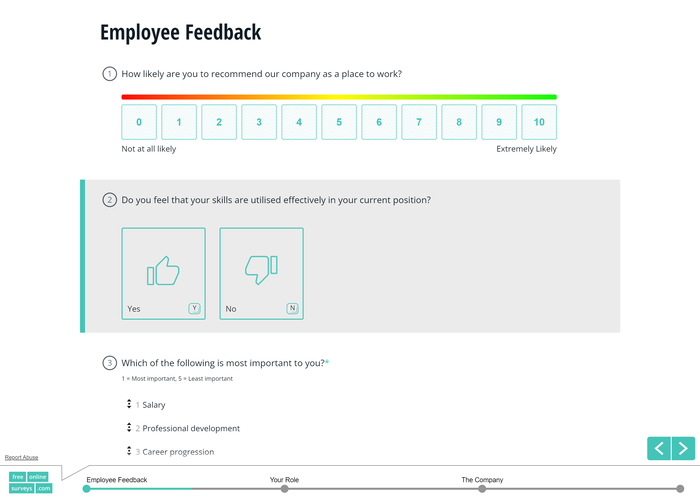

7. Employee satisfaction

Employee satisfaction surveys (sometimes referred to as job satisfaction surveys) are conducted to learn how happy employees are in their roles and working at a company.

The main aim here is to improve employee happiness, which will in turn boost performance in the workplace and increase employee retention.

For the most part, you should collect anonymous feedback with these surveys. This will empower employees to be as honest as possible when submitting a response.

ESAT scores can also be taken as part of wider climate surveys in your organization.

8. Employee engagement

Employee engagement is a metric for measuring how motivated employees are to perform their role. Satisfaction can absolutely be a contributing factor here, but the reasons employees aren’t engaging with their role can be far wider reaching.

These can include:

- Sense of purpose

- Work/ life balance

- Schedule flexibility

- Career development

- Peer relationships

- Company culture

Your goal if to identify why employees aren’t engaged and take action on that feedback.

10. Onboarding

Onboarding is a critical phase in the employee lifecycle that encompasses the activities and experiences new hires go through to integrate into their roles, teams, and the overall organizational culture.

These surveys provide valuable insights into the effectiveness of the onboarding program and help identify areas for improvement.

These surveys may cover various factors:

- Orientation

- Training and development

- Team integration

- Access to resources

The primary goal is to identify areas of improvement in the onboarding process. Organizations can use feedback to refine their onboarding programs after each new hire.

11. Employee exit

Exit surveys allow companies to learn why employees have chosen to leave the business and what their overall employee experience was like.

They’re essential to identifying the contributing factors to employee turnover and can help improve job satisfaction and workplace culture.

And because there is no fear of consequences for departing employees, you’ll find that exit surveys collect some of the most honest feedback.

These surveys can be conducted on paper during an exit interview, but for the most honest feedback you might consider using online survey software. The pressure of a in-person interview might well impact the kind of feedback that employees are willing to share.

12. Training evaluation

Training evaluation surveys are intended to assess the effectiveness of training programs within an organisation. The goal here is to gather insights on different aspects of the training to help fine-tune programs for future sessions.

These aspects can include:

- Content

- Session length

- Delivery and format

- Impact on skills and performance

- Relevance to job roles

- Instructor effectiveness

This feedback should be collected after all sessions and training programs to drive continuous improvement

Product surveys

Next we have surveys that help you learn more about the strengths and weaknesses of your products and services.

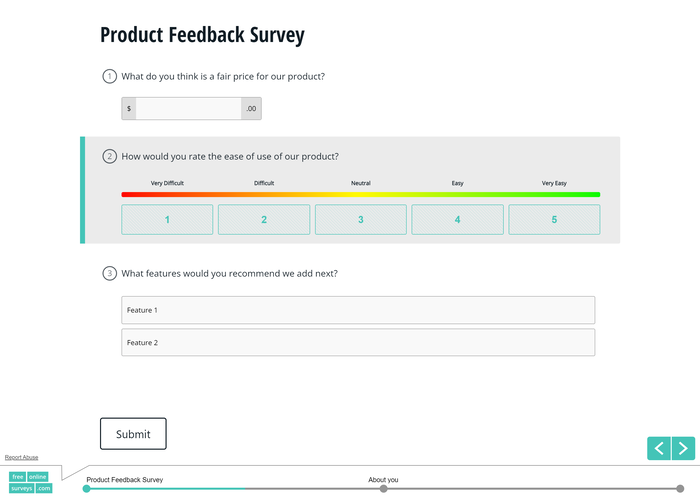

13. Pricing

The primary objective of pricing surveys is to collect data on how customers perceive the value of a product or service at different price points. This information is crucial for businesses to set competitive and customer-centric pricing.

These surveys help companies position their products in competitive marketplaces, adjust existing pricing structures, and explore the effectiveness of discounts, promotions, and bundles.

14. Product research

Product research surveys are a form of market research designed to gather insights and feedback from current or potential customers about a particular product or service.

These surveys help companies understand customer preferences, identify areas for improvement, and make informed decisions regarding product development, marketing strategies, and overall product positioning in the market.

Some topics that should be covered in these surveys for companies are:

- Product features

- User experience (UX)

- Price perception

- Purchase intent

- Customer demographics

- Quality and performance

- Competitor comparison

Product research surveys should be conducted at multiple points throughout a products lifecycle to benchmark performance with your customers.

Supplier surveys might also fall into this category, as you’ll need to do your due diligence when appraising suppliers for your business.

15. Feature prioritisation

Feature prioritisation surveys allow companies to determine which features and functionalities to prioritise next for their product or service.

There are two ways you can go about collecting this feedback. Firstly, you could run an initial survey where customers make feature suggestions in bulk.

Then you can identify the most frequently suggested features and create a priority list.

Alternatively, you could create a list of features you intend to introduce, and allow customers to rank them in order of their priority.

The feature placed most in the first position would indicate where you should start to please the most customers.

16. Product concept testing

Product concept surveys are designed to evaluate the viability and appeal of new product or service ideas, before they are developed or launched.

These surveys will typically include a detailed description of the product, along with concept images and possibly even marketing videos.

Similarly to product research surveys, you should address aspects like target audience, competitor comparisons, scalability and price perception.

With features like split testing in surveys, you can test concepts for multiple products and identify the most popular concept in one fell swoop.

Brand surveys

Now we’ll get into surveys for companies that can help you build a stronger brand, measure recognition across different audiences, and determine the success of ads.

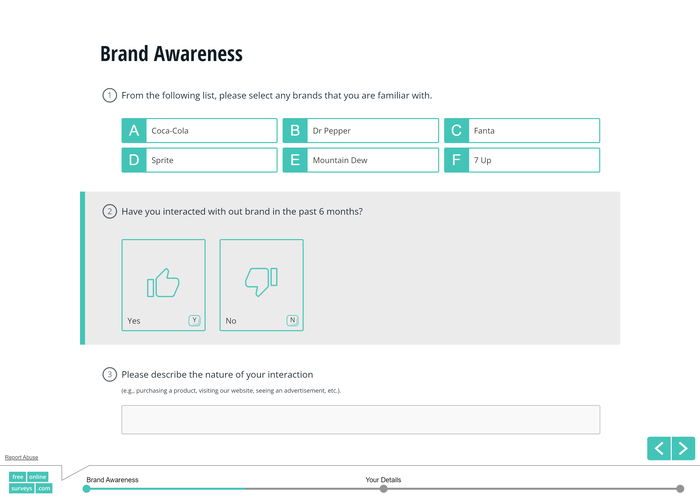

17. Brand awareness

Brand awareness surveys enable businesses to measure the level of recognition and awareness that a target audience has for their brand. These surveys contain aided and unaided awareness questions.

Unaided awareness questions assess how well respondents can spontaneously recall a brand without any prompting.

Aided awareness questions, on the other hand, provide respondents with a list of brands and ask them to identify the ones they are familiar with.

Typically, brand awareness surveys should collect feedback on:

- Brand recall

- Competitor comparison

- Consumer perception

- Market penetration

- Brand loyalty

Brand awareness surveys should be conducted periodically to track changes in brand recognition and assess the impact of marketing campaigns over time.

18. Ad testing

Ad testing surveys, also known as advertising effectiveness surveys, evaluate the impact and performance of advertising campaigns.

These surveys provide insight on how target audiences perceive and respond to ads, helping companies refine their messaging, creative elements, and overall advertising strategies.

Some aspects of your ad campaigns you should collect feedback on are:

- Timing

- Purchase intent

- Competitor advert comparison

- Message effectiveness

- Brand recall

This feedback should be used to maximise the impact of ad campaigns in the future, and it’s important to collect that feedback as frequently as possisble.

19. Social media

Social media surveys for companies are research tools designed to gather feedback, insights, and opinions from audiences on various social media platforms.

These surveys help businesses understand their audience’s preferences, perceptions, and behaviours related to products, services, or the overall brand.

Social media surveys can be conducted on Facebook, X (formerly Twitter), Instagram, LinkedIn, and other platforms, allowing companies to engage directly with their online communities.

Marketing surveys

The following surveys will enable you to optimise your marketing strategies, increase conversions , and do more with customer data.

20. Market research

Market research surveys aim to gather information about a company’s target market, with the purpose of understanding consumer preferences, market trends, and competitor activities.

These insights can then be used to inform marketing strategies, product development, and even investment opportunities for businesses.

More importantly, they allow you to identify your target audiences, learn about their wants and needs, and tailor your activities to maximise sales.

21. Customer segmentation

Much like market research surveys, customer segmentation surveys give businesses an opportunity to learn demographic and psychographic information about their target audience.

However, these surveys are structured in a way that allows you to easily create customer segments and buyer personas.

There would be a greater focus on quantitative data, which can be easily filtered in your survey results to identify patterns and trends.

Of course, qualitative data is still necessary to shed light on why customers chose specific answers.

22. Lead generation

Lead generations surveys allow companies to identify and qualify leads. Typically, they are run alongside lead generation campaigns, where at some point during that pipeline the survey is conducted to collect insights on potential customers.

Responses to lead generation surveys can be used to assign lead scores, helping prioritise and categorise leads based on their level of interest, engagement, and alignment with the company’s offerings.

Of course, the survey itself could be used as a lead magnet, whilst you collect data about leads at the same time. In this scenario, you would likely need to offer an incentive to those who complete the survey (e.g. a discount).

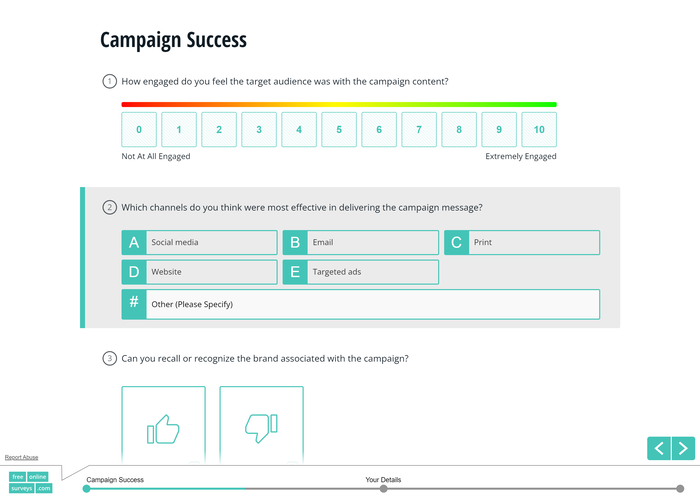

23. Campaign success

Campaign success surveys are very similar to ad testing surveys, where a specific campaign is put under the microscope by a company.

Some specific campaign elements you can gauge the success of are:

- Calls-to-action

- Customer engagement

- Brand awareness and recall

- Distribution channel evaluation

- Accuracy of audience targeting

This type of survey helps you measure the success of campaign strategies, identify areas for improvement, and collect insights that might strengthen future campaigns.

24. Small business

Small business surveys can cover a wide variety of topics, and their goals can align with almost any other survey type in this list.

However, the aim of these surveys is to learn how to grow your small business, improve market positions, and identify areas for improvement.

Of course, business startup surveys can also be created to identify gaps in the market. There’s no stronger foundation for a new business than one laid in quantifiable data.

Website surveys

Your website is often a potential customers first impression of your company, and so website surveys can help you make sure that impression is a good one.

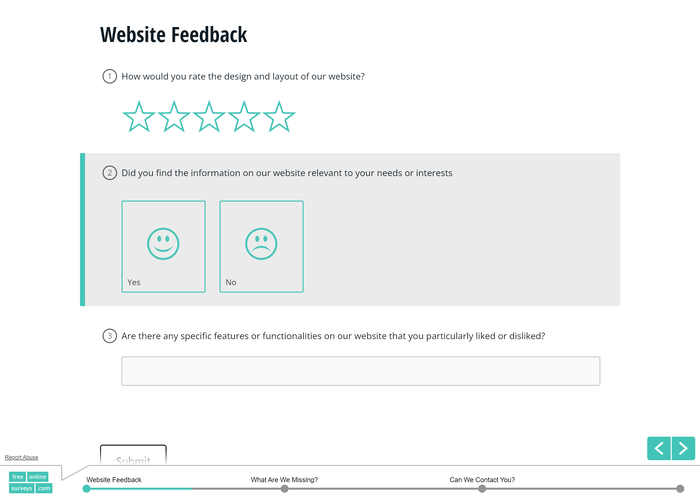

25. Website feedback

Website feedback surveys are a way of collecting opinions and suggestions from visitors that can help you remove friction, increase conversions, and improve user-experiences.

They can be strategically triggered as pop-ups after a certain amount of time on a page or even embedded on the page itself.

These surveys can be used to collect bug reports, evaluate content performance, gauge responsiveness across different devices, and to learn more about your audience in general.

26. Landing page feedback

Landing page surveys are more specific than website feedback surveys, as they collect feedback on a single webpage. You’ll be covering may of the same topics, such as content and responsiveness, with the goal of optimising a landing page to maximise conversions.

This type of survey goes really well in hand with A/B testing, where different versions of a landing page are shown to visitors.

By comparing the feedback from each, you can easily identify which page produced the most positive experiences.

27. Exit-intent

Exit-intent surveys are even more specific again, designed to capture feedback from website visitors at the moment they show intent to exit a webpage.

Their main purpose is to identify why a visitor is leaving the page and learn how the page can be improved to retain user interest.

Exit-intent surveys are triggered by specific user behaviours, such as moving the mouse cursor towards the browser’s close button or attempting to navigate away from the site.

Event surveys

Finally, let’s get into the different types of surveys that can help you organise and improve events for ultimate guest satisfaction.

28. Registration

Event registration surveys are designed to determine the number of people who will be attending an event. They usually consist of a binary yes/no question, or potentially a multiple-choice question that contains a “maybe” answer option.

You may also want to collect attendee contact information, such as names and email addresses, to follow up with important updates on the event itself.

29. Pre-event

Pre-event surveys are shared with potential attendees before and event to collect insights on expectations, preferences, and needs. This way, events can be organised to best suit those who will attend.

Some feedback you can collect with pre-event survey questions are:

- What kind of content attendees want to see.

- How did they learn about the event.

- What are their menu preferences.

- When would they like sessions to take place.

If you haven’t run a separate registration survey, you would also need to collect attendee contact information to keep them updated on the event and send follow up surveys.

30. Mid-event

As the name suggests, mid-event surveys collect feedback and insights from attendees during an ongoing event. These are a way for organisers to gauge how the event is going and to determine if any last minute changes can be made to improve guest experiences.

The kind of feedback collected can also be used to inform future events and even what questions will be asked in a post-event survey.

31. Session feedback

Session feedback surveys are more granular, where attendees can provide feedback on individual sessions during the event. For example, after running a seminar you’ll want to learn what kind of impact it had on those who attended.

In these types of surveys, you could address these following aspects of the session:

- Content relevance

- Session leader effectiveness

- Format in which content was presented

- Session times

- Comprehensiveness of content

Typically, these surveys are administered after the vent is concluded. But for the most accurate feedback, we’d recommend conducting them as soon after the session as possible.

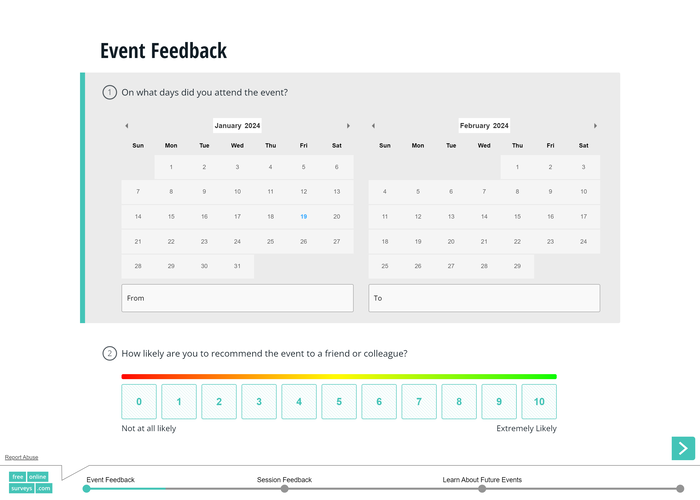

32. Post-event

Post-event surveys are shared with attendees to collect feedback on an event once it has concluded. this information helps organisers understand what worked well, and where there is need for improvement.

Alongside session feedback, logistics and activities, you’ll also be gauging overall satisfaction for the event. This is an important metric, as it’s something you’ll want to use to benchmark future events by.

Some of aspects of an event you’ll want to collect feedback on are:

- Networking opportunities

- Session& speaker evaluations

- Learning outcomes

- Content relevance

- Likelihood to recommend the event (NPS)

We’d also recommend collecting demographic information at this point. This will help you identify who your ideal audience is for future events, and create segments for this audience.

33. Virtual event feedback

Virtual event surveys are much the same as other types of event surveys with one caveat, that the technical elements of the event must also be addressed.

For example, if you’ve hosted a webinar, it’s essential that you collect feedback on how this affected the experience of attendees.

Was connection stable the entire time? Was the audio quality clear enough? Did content have the same impact as it would have at a live event?

You really need to think about the different ways switching to an online forum can impact guest satisfaction.

Wrapping up

That wraps us up for the list of surveys for companies! If you think we’ve missed one, please do get in touch and we’ll add your suggestion to the list.

If you’re looking to create business surveys without blowing the budget, take a look at these free online survey tools to help you get started today.